How Fortitude Financial Group can Save You Time, Stress, and Money.

How Fortitude Financial Group can Save You Time, Stress, and Money.

Blog Article

The 2-Minute Rule for Fortitude Financial Group

Table of ContentsExcitement About Fortitude Financial GroupThe smart Trick of Fortitude Financial Group That Nobody is DiscussingFortitude Financial Group Can Be Fun For AnyoneFortitude Financial Group Fundamentals ExplainedSome Of Fortitude Financial Group

Note that several experts will not handle your properties unless you satisfy their minimal demands (Financial Resources in St. Petersburg). This number can be as low as $25,000, or reach into the millions for the most unique advisors. When picking a financial advisor, discover if the specific complies with the fiduciary or suitability criterion. As kept in mind earlier, the SEC holds all experts signed up with the agency to a fiduciary criterion.If you're seeking monetary suggestions however can't manage a financial consultant, you may think about using an electronic investment expert called a robo-advisor. The wide area of robos extends platforms with accessibility to monetary consultants and financial investment administration. Encourage and Improvement are 2 such examples. If you fit with an all-digital system, Wealthfront is an additional robo-advisor alternative.

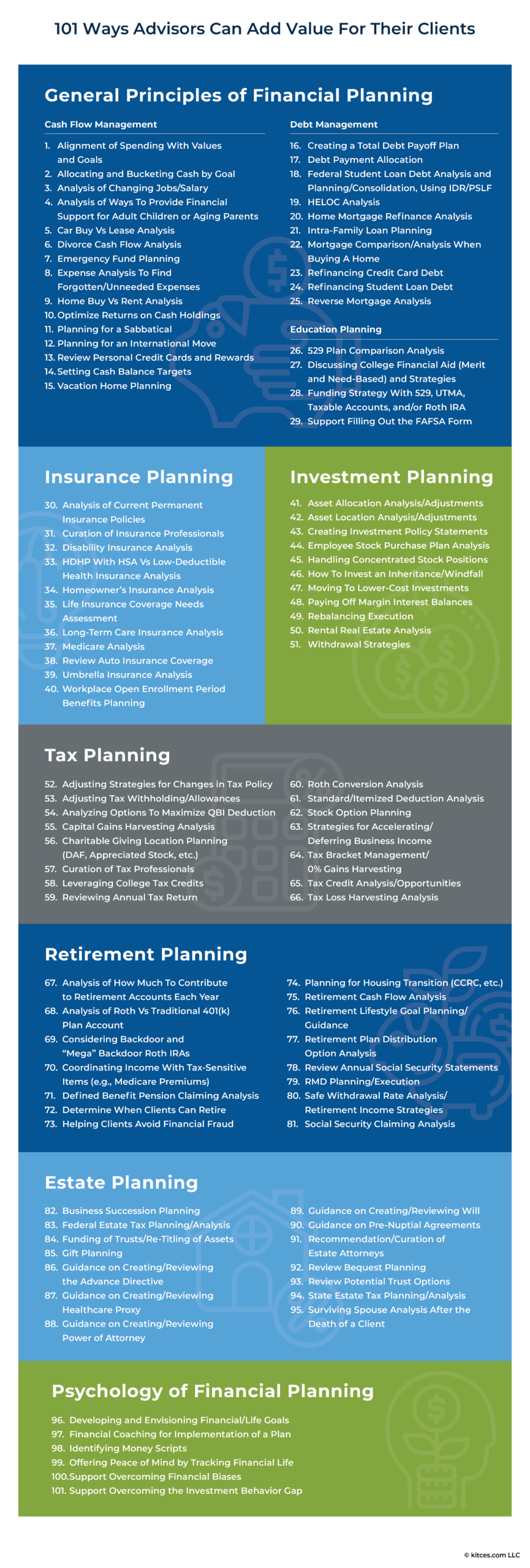

You can discover a financial advisor to help with any type of aspect of your monetary life. Financial consultants may run their own company or they could be component of a bigger workplace or financial institution. No matter, a consultant can aid you with everything from constructing a monetary plan to spending your money.

An Unbiased View of Fortitude Financial Group

Examine that their qualifications and skills match the solutions you want out of your advisor. Do you want to learn more about monetary experts?, that covers concepts bordering precision, credibility, editorial freedom, expertise and neutrality.

Many individuals have some emotional connection to their cash or the important things they acquire with it. This psychological link can be a key reason we might make poor financial decisions. A professional monetary advisor takes the emotion out of the formula by giving objective advice based upon knowledge and training.

As you experience life, there are economic choices you will make that could be made extra easily with the assistance of a specialist. Whether you are trying to lower your debt lots or desire to begin intending for some lasting goals, you might profit from the solutions of a financial consultant.

7 Simple Techniques For Fortitude Financial Group

The fundamentals of investment administration include acquiring and selling financial properties and other investments, but it is moreover. Handling your financial investments includes understanding your brief- and lasting goals and making use of that details to make thoughtful investing choices. A monetary consultant can supply the information essential to help you expand your investment portfolio to match your desired degree of danger and fulfill your monetary objectives.

Budgeting gives you an overview to just how much money you can spend and just how much you must conserve each month. Adhering to a budget will certainly assist you reach your short- and lasting financial goals. A financial expert can assist you describe the action steps to take to establish up and maintain a budget plan that functions for you.

Often a clinical expense or home repair service can suddenly include in your debt load. A professional debt administration plan aids you repay that financial debt in one of the most financially useful way possible. An economic expert can assist you assess your financial obligation, focus on a debt payment approach, offer options for debt restructuring, and describe a holistic strategy to much better manage financial obligation and satisfy your future economic objectives.

Our Fortitude Financial Group PDFs

Individual money circulation analysis can tell you when you can afford to buy a brand-new automobile or just how much cash you can include in your cost savings monthly without running brief for essential expenditures (Investment Planners in St. Petersburg, Florida). A financial consultant can help you clearly see where you spend your cash and after that apply that insight to help you understand your monetary wellness and just how to improve it

Danger administration solutions determine potential dangers to your home, your vehicle, and your household, and they help you place the ideal insurance plan in position to alleviate those threats. An economic consultant can help you establish a technique to shield your making power and minimize losses when unexpected things happen.

Excitement About Fortitude Financial Group

Lowering your taxes leaves more money to contribute to your investments. Investment Planners in St. Petersburg, Florida. A financial expert can help you utilize charitable providing and financial investment methods to lessen the quantity you have to pay in taxes, and they can show you how to withdraw your money in retired life in such a way that likewise lessens your tax obligation worry

Even if you really did not start early, college preparation can help you put your kid with college without encountering suddenly big expenses. An economic expert can lead you in understanding the very best methods to save for future college costs and how to money potential voids, explain exactly how to minimize out-of-pocket college expenses, and advise you on eligibility for financial assistance and gives.

Report this page